Revenues generated by digital English language learning products are set to explode according to a comprehensive report of the market by US-based Ambient Insight. The research predicts a compound annual growth rate of 11.1% for global sales over the next five years increasing revenue from US$1.3bn to US$3.8bn.

News and business analysis for Professionals in International Education

Have some pie!

Mobile to propel boom in digital English language learning revenues

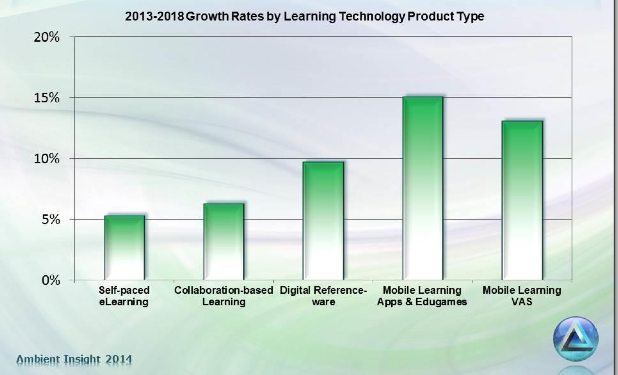

Demand for mobile learning will see apps, edugames and mobile learning value added services (VAS) edge out traditional self-paced e-learning products during the forecast period. “Clearly all roads lead to mobile,” the report predicts.

Large-scale digitalisation initiatives, government backed policies to increase English proficiency and consumer demand for digital language learning products are driving global growth.

Consumers in many countries will be outspending the government agencies in many countries…due to the rapid rollout of mobile broadband across the world

However, as digital learning becomes more widely accepted, consumer demand for mobile learning is dictating growth trajectories.

“Consumers in many countries will be outspending the government agencies in many countries by the end of the forecast period due to the rapid rollout of mobile broadband across the world, the availability of very low-cost smartphones and tablets, and the boom in demand for educational apps,” the report states.

A new category of digital learning, Mobile Learning VAS– which pairs telecomms providers with content generators to send content via audio, text message or interactive voice response to subscribers at low cost– was introduced in the market in 2008 and is slotted for significant growth.

By the end of last year there were 76 English related Mobile Learning VAS products in the world with 18 new offerings already coming onto the market by July of this year according to the research.

“The Mobile Learning VAS offerings in developing economies have relatively low subscription prices, yet have millions of customers,” the report says. “Consequently, the revenues are quite high. This is a classic ‘rags to riches’ story with suppliers across the planet collectively generating hundreds of millions of dollars in new revenue in just the last two years.”

The sector will also be bolstered by the dramatic increase in private investments made to digital English language learning suppliers like Voxy and the steady adoption of commercial digital products in the already thriving private English language learning industry.

Tas Viglatzis, Managing Director at Pearson English, a leading private provider, confirmed that the company is seeing increasing adoption rates across its digital product portfolio. “Particularly for MyEnglishLab, our flagship platform,” he added speaking to The PIE News.

“This is driven by a number of factors including geography, accessibility, and promotion by governments to students and in schools.”

Private providers also report that digital learning products are helping drive traffic to traditional courses.

“It’s not an end in itself, it’s getting more people on the ladder into the English language learning area, hopefully building their confidence,” commented Michael Carrier, director of strategic partnerships as Cambridge English Language Assessment.

“It’s taking them from lower levels of skill and competence to higher levels where it would make more sense for them to invest in coming to the UK or would make more sense to do a more expensive English language programme at a language school or institute.”

The increase in government mandates worldwide to improve English language teaching in the public sector will also create opportunities for digital learning developers the report underlines.

“Mobile Learning VAS suppliers across the planet have collectively generated hundreds of millions of dollars in new revenue in just the last two years”

“Language improvement for teachers of English is a really big issue,” agreed Carrier. “There are about 12 million English language teachers in the world working in state education and public school education and in many cases they still have challenges with their own language proficiency.”

The report gives five year forecasts for 98 countries and found developing markets are predicted to have the highest growth rates. However, China, the US and South Korea, Japan and Brazil will continue to be the top buying countries.

Indonesia, Poland and Malaysia will emerge as additional top buying countries in 2018. “These countries now represent significant revenue opportunities for suppliers,” the report says.

Meanwhile, regions forecast to have the highest predicted growth rates are Africa, Asia and Latin America at 20.5%, 14.2%, and 13.8% respectively.

Still looking? Find by category:

The challenge for English language learners will be to determine which of the digital language learning products are worth spending time on. It is very difficult to test the product without going through it, which in many cases, will probably be a waste of the learners time. An external assessment of these products would be great, but who would want to spend the time and effort doing so. Therefore, in the meantime, buyer beware.

I agree with Perry, and I have a few questions.

1. Where is any cost info on this topic?

2. Why is the platform (mobile) seem to carry more weight than the effectiveness of the software?

3. Why aren’t these potential mobile customers using the non-mobile, but effective language-learning software that’s available now?

It appears to me that the Pioneer consumers are going to experience a lot of frustration and failure because a mobile app isn’t going to change the burden of language learning from the learner to the device.