Canada’s market share of international students is likely to grow following Covid-19 and its government’s handling of the crisis, agents have suggested, while US market share is expected to witness a “marked decline”.

News and business analysis for Professionals in International Education

Have some pie!

Canada to expect growth and US to lose market share, agents predict

International student numbers are "likely" to drop from 2.5 million to 2 million as a result of the pandemic, and its resulting uncertainty for students and agents. Photo: Pexels

International student numbers are "likely" to drop from 2.5 million to 2 million as a result of the pandemic, and its resulting uncertainty for students and agents. Photo: Pexels Surveying some 400 agents from 63 countries, global education provider Navitas found that agents also estimated Australia would see a “slight decline” in market share, while there is a “slight increase” predicted for the UK.

Overall, international student numbers are “likely” to drop from 2.5 million to 2 million as a result of the pandemic, and its resulting uncertainty for students and agents.

“It is apparent that all destinations are facing similar challenges but countries have responded differently to the pandemic”

In the worst-case scenario, the overall international student market could shrink by 40%, dropping to a total of 1.5m.

Around three in five agents responding from countries across the world said they could predict a likely shift in market share with a “seemingly high degree of confidence”.

The analysis suggested that in the “more likely” scenario the USA’s market share would shrink from 44% pre-Covid to 37% post-Covid, while Australia’s will fall by 1%, from 18% pre-Covid to 17% after the pandemic.

Other popular Anglophone destinations Canada and the UK can expect higher shares of 21% and 20% respectively – both up from 19%, it noted, while unknown destinations are expected to gain 4% of market share.

If the global market decreased to two million students, all countries are facing a reduction in enrolments – while Canada’s drop of 52,000 students will be “relatively small”, the impact on the US would be “extremely large” at minus 350,000 students.

“We are now in the depths of the coronavirus disruption and it is apparent that all destinations are facing similar challenges, but countries have responded differently to the pandemic, and to the plight of international students,” explained author of the report and head of Strategic Insights and Analytics at Navitas, Jonathan Chew.

Chew’s analysis suggested the UK is positioned to gain market share than Australia thanks to its reinstatement of post-study work rights, which may help to continue to convert the country’s pre-Covid19 momentum.

At the time of the survey, the UK’s borders remained open while Australia’s were not, in addition to its geographical location in the Northern hemisphere making it “better placed” to capitalise on any US loss of market share.

However, “it is very difficult for any one country to achieve rapid shifts in market share”, the report continued, adding that Canadian and Australian market share gains since 2012 were “driven at least in part by the UK’s removal of post-study work rights”.

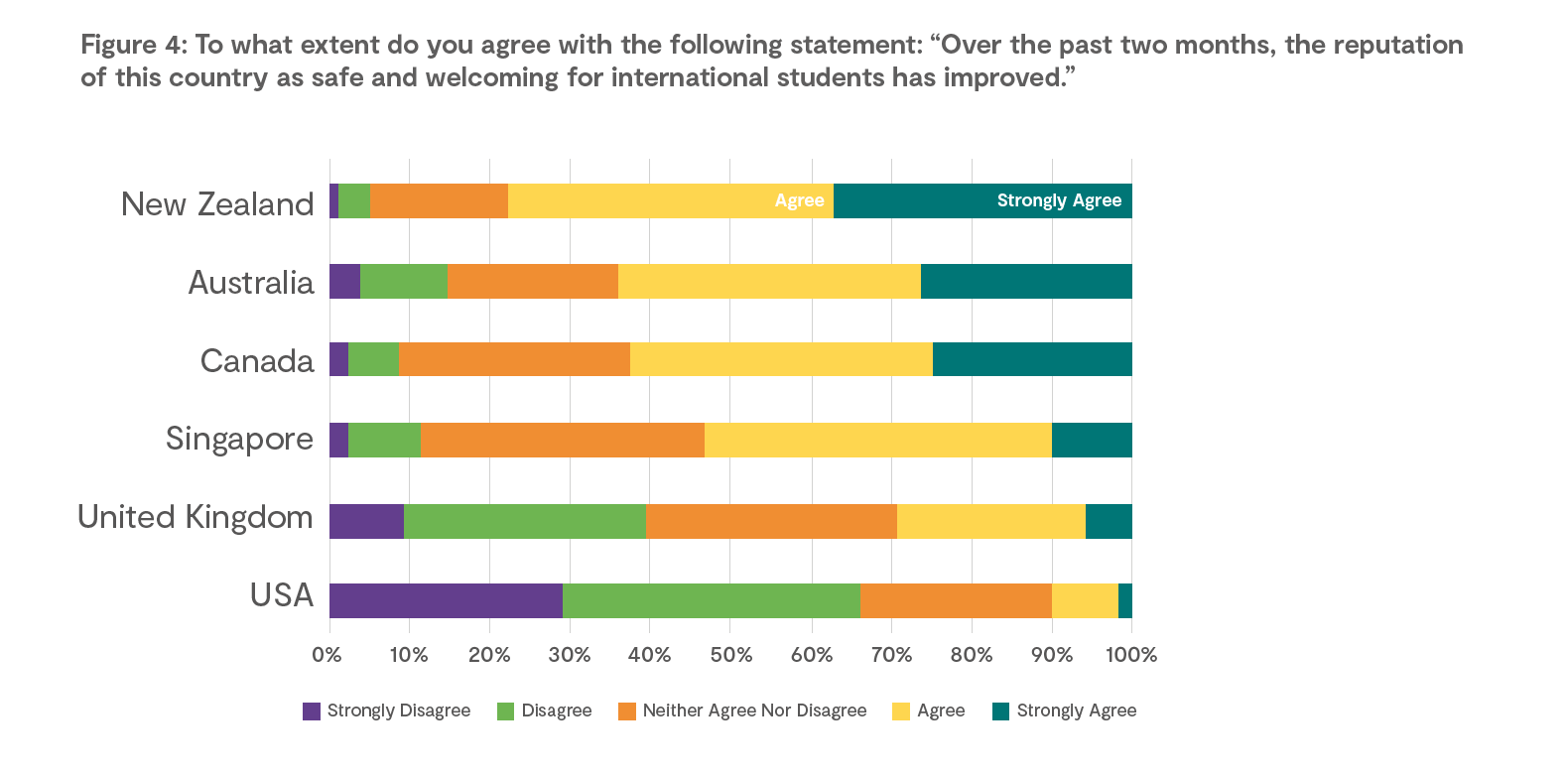

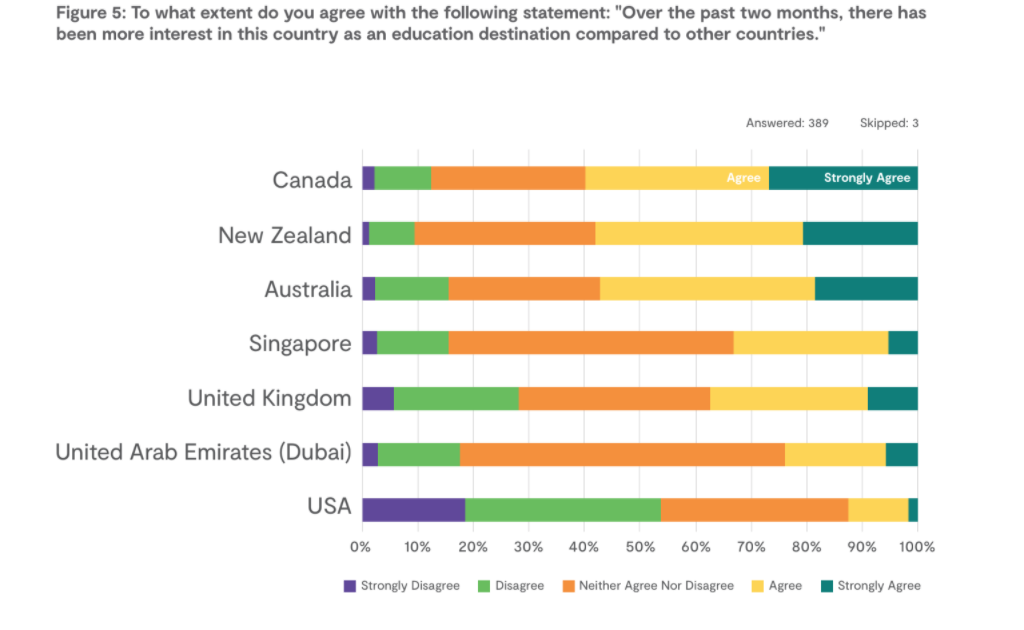

Australia, New Zealand and Canada all rated highly when asked whether interest in the country had increased during the pandemic and whether reputation for safety and a welcoming atmosphere had improved.

The market is yet to see whether reputation boosts earned by countries the countries will translate into student enrolments over the next months, the report added.

The trajectory of the coronavirus pandemic globally and border policies of individual countries will determine future enrolment, it said.

“This analysis indicates just how important it is for a destination country to successfully navigate the dual public health and economic crises,” Chew concluded.

“In addition, it will be the attractiveness of each destination’s international education policy settings and their investment in their national brands that will determine where those large numbers of ‘not yet committed’ students choose to study.”

Still looking? Find by category: